Medicare Supplement, or Medigap, plans fill in the gaps in coverage left behind by Original Medicare, such as deductibles, coinsurance, and copayments. Every Medigap policy must follow federal and state laws designed to protect you, and it must be clearly identified as “Medicare Supplement Insurance.” Insurance companies can sell you only a “standardized” policy identified in most states by letters. The best time to enroll in a plan is during the Medigap Open Enrollment Period, which begins on the first day of the month that you are both age 65 or older and enrolled in Part B, and lasts for six months. During this period, you have the guaranteed issue right to join any plan of your choice, meaning that you may not be denied coverage based on any pre-existing conditions. If you miss this enrollment period and attempt to enroll in the future, you may be denied coverage based on your medical history.

Types of Medicare Supplement Plans

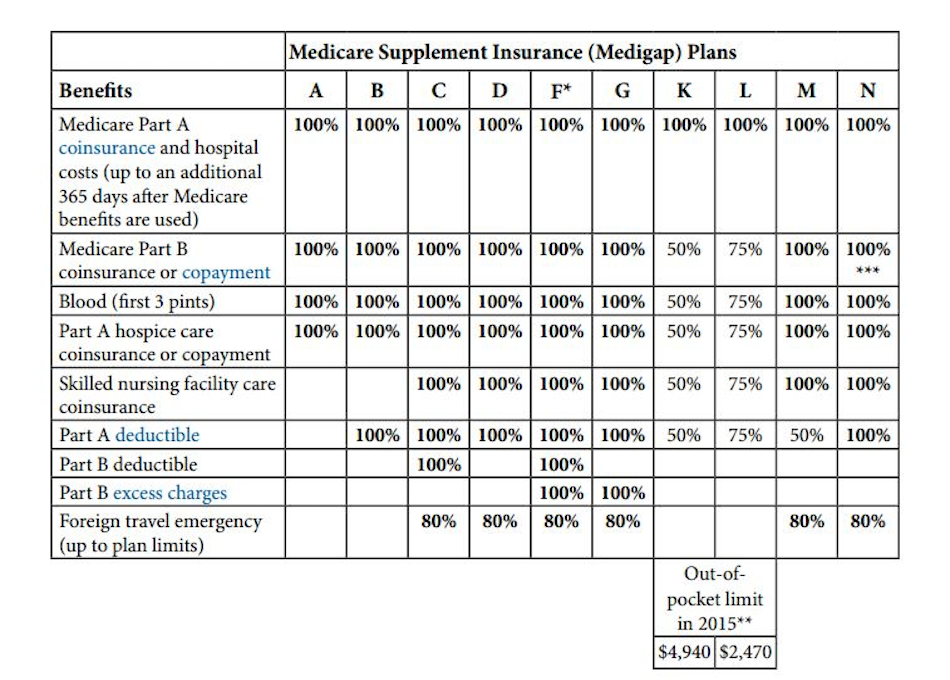

There are 10 standardized Medigap plans that are denoted by the letters A through N. The private insurance companies offering these plans do not have to offer every Medigap plan. Insurance companies selling Medigap policies are required to make Plan A available. If they do not offer any other Medigap policy, they must also offer either Medigap Plan C or Plan F. Not all types of Medigap policies may be available in your state.

Although private insurance companies are required to offer the same benefits for each lettered plan insurance companies may charge different premiums for the same exact policy. Plans may price their plan premiums in the following ways:

- Community no-age-rated: These plans require premiums that are the same across the board, regardless of age.

- Issue-age-rated: These plans base their premiums on the age you were when you first enrolled in the policy. Therefore, the younger you are when you enroll in this type of plan, the lower your premium will be.

- Attained-age-rated: Like issue-age-rated, these plans base their premiums on the age you were when you first bought a policy, but unlike issue-age-rated, premiums increase as you get older.

Deciding which plan to enroll in can be difficult, especially since there are so many different plans to choose from. That’s why it’s important to define one’s medical and financial goals. NIC will research plans that fit within your strategy and explain in detail the plan and the potential the plan has to help you meet your specific goals. Whether you live on a fixed income or have a comfortable nest egg we will help you choose the best possible plan for you.

NIC can provide you with a wide range of Medicare Supplement consulting services, including:

- Impartially shopping standardized plan costs for you

- Individual plan selection

- Help in deciding what benefits will accomplish your goals